Introduction

As we enter 2024, effective retirement planning becomes increasingly crucial for ensuring financial security in the later stages of life. Building a robust retirement fund and managing longevity risk are key components of a successful retirement strategy. This article provides essential tips for retirement planning in 2024, focusing on strategies for accumulating wealth, managing investments, and preparing for a secure and comfortable retirement.

1. The Importance of Retirement Planning

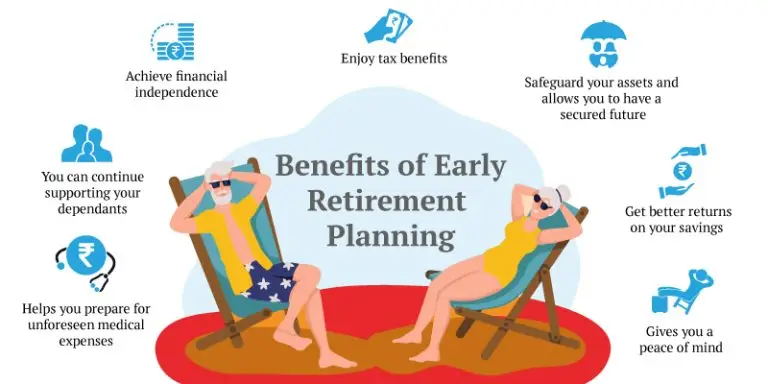

Retirement planning involves preparing financially for the period after you stop working. Key reasons to plan include:

- Ensuring Financial Independence: To maintain your lifestyle and cover living expenses without relying on others.

- Managing Longevity Risk: To ensure you have enough funds to last through retirement, potentially lasting 20-30 years or more.

- Planning for Healthcare: To cover medical expenses, which can increase as you age.

2. Essential Tips for Retirement Planning in 2024

1. Start Early and Save Consistently

[Insert overview, key actions, and sources]

2. Diversify Your Investments

[Insert overview, key actions, and sources]

3. Plan for Healthcare Costs

[Insert overview, key actions, and sources]

4. Estimate Your Retirement Needs

[Insert overview, key actions, and sources]

5. Review and Adjust Your Plan Regularly

[Insert overview, key actions, and sources]

3. Common Retirement Planning Mistakes to Avoid

- Underestimating retirement expenses

- Ignoring inflation

- Failing to plan for healthcare costs

- Overlooking tax implications

4. Frequently Asked Questions (FAQs)

Q1. What is the ideal age to start retirement planning?

It’s best to start as early as possible, ideally in your 20s or 30s, to maximize the benefits of compound interest.

Q2. How much should I save for retirement?

Aim to save at least 15-20% of your income for retirement, adjusting based on your specific needs and goals.

Q3. What are the best investment options for retirement?

Diversify your investments across mutual funds, fixed deposits, bonds, and real estate to balance risk and returns.

Q4. How can I ensure my retirement savings last?

Plan for a sustainable withdrawal rate, diversify your investments, and regularly review and adjust your retirement plan.

Conclusion

Effective retirement planning in 2024 involves starting early, diversifying investments, planning for healthcare costs, and regularly reviewing your strategy. By following these essential tips, you can build a solid retirement fund and manage longevity risk, ensuring a secure and comfortable future. Whether you’re just beginning or looking to optimize your existing plan, taking these steps will help you achieve your retirement goals.

Sources:

- National Institute on Retirement Security (NIRS): Importance of Retirement Planning

- Financial Planning Standards Board (FPSB): Retirement Planning Guidelines

- Securities and Exchange Board of India (SEBI): Investment Strategies for Retirement